The M&A journey of aircraft component maker GAZC in India

'Solid agreements beforehand and a post-acquisition integration strategy are essential for success'

GAZC, a Spanish manufacturer of components for the aerospace industry, first teamed up with Indian manufacturing company Paravan for an order from their joint customer Tata. When it became known that Paravan was in financial trouble, GAZC saw an opportunity to take over part of the company. This allowed Paravan to regain financial stability and GAZC to continue working with Tata, while also allowing them to manufacture in India at a lower cost.

The acquisition process

Both parties were excited about the idea of a partial acquisition and the opportunities it would create for them, so after several conversations and sharing some basic financial information with each other, they drafted a Letter of Engagement, which established the initial agreed value and the framework for further sharing of financial information.

Due diligence

For the next step in the process, thorough due diligence, GAZC decided to hire an expert. IndiaConnected began the investigation of Paravan with a special focus on the company’s financial situation, which presented unique challenges. Paravan had accumulated significant credit obligations with a local Indian bank that exclusively served Indian companies.

This created a complication: in the event of a foreign takeover, the bank planned to terminate its relationship with Paravan and demanded immediate repayment of all outstanding loans.

To resolve this issue, GAZC negotiated an additional agreement with the bank, which stipulated that the loans would be repaid in full upon receipt of the share transfer certificate. Throughout this process, local IndiaConnected experts proved invaluable in dealing with cultural differences and facilitating communication.

Based on the findings of the due diligence, the parties negotiated a revised valuation for the acquisition.

Legal framework

A comprehensive shareholder agreement was drafted by specialized local lawyers with expertise in the industry and in cross-border transactions. This approach ensured that the agreement would align well with Indian legal requirements while protecting GAZC’s interests.

GAZC initially acquired a 50% interest in Paravan, with an explicit provision in the agreement to increase their ownership to 70% in the future. This phased approach allowed GAZC to gain operational control while managing risk.

The share transfer process that followed the acquisition revealed important differences between European and Indian business practices. In Europe, it is common in such transactions for a notary to sign the buy-sell agreement, along with proof of cash transfer, completing the process relatively quickly. In contrast, the Indian share transfer began in July but was not officially completed until February of the following year – a seven-month wait.

A potential obstacle surfaced during this phase: the land on which Paravan operated had been purchased from the Indian government under a condition that prohibited sales to foreign companies. Fortunately, this problem could be resolved with the help of IndiaConnected’s local experts.

Post-acquisition integration

Financial challenges

After the acquisition, several financial problems still surfaced. Paravan had accumulated several loans, was behind in paying salaries and failed to pay social security contributions. Although the company was receiving orders, it lacked working capital and had taken out loans to fill this gap, often using the funds improperly.

To address these issues, GAZC deployed a financial advisor from IndiaConnected who is on-site three days a week to resolve the financial discrepancies.

Operational integration

GAZC retained Paravan’s entire workforce of 80 employees, despite the fact that the same output could be achieved with about 40 employees in Spain. This decision was part of a business plan developed during the due diligence phase that anticipated future expansion.

The Spanish company also added three new positions to strengthen oversight and added financial controls, including a requirement that any expenditure over $1,000 be approved by Spanish headquarters. The CFO initiated efforts to integrate Paravan’s financial reporting with GAZC’s systems.

Culture and management challenges

There are significant cultural differences in management practices between the two countries from which the companies originate. In Europe, employees tend to work with different responsibilities, while employees in India tend to adhere strictly to specific job descriptions.

Initially, the relationship between the Spanish and Indian shareholders was positive, and the former Indian owner was appointed country manager. A few months after the acquisition, however, tensions began to arise. The former owner, who was used to having full authority, did not consistently inform Spanish management of his decisions.

Another concern was financial transparency. Since the finance team reported to the Indian shareholder, GAZC executives were uncertain whether they were receiving complete information. This led GAZC to consider appointing a neutral manager chosen by both parties.

Despite the challenges, the acquisition appears to be yielding positive results. Paravan’s sales have already grown from €3 million to €5 million following the acquisition, showing that GAZC’s strategic investment is beginning to pay off.

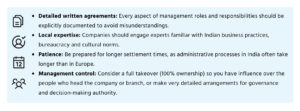

Recommendations for mergers and acquisitions by foreign companies in India: